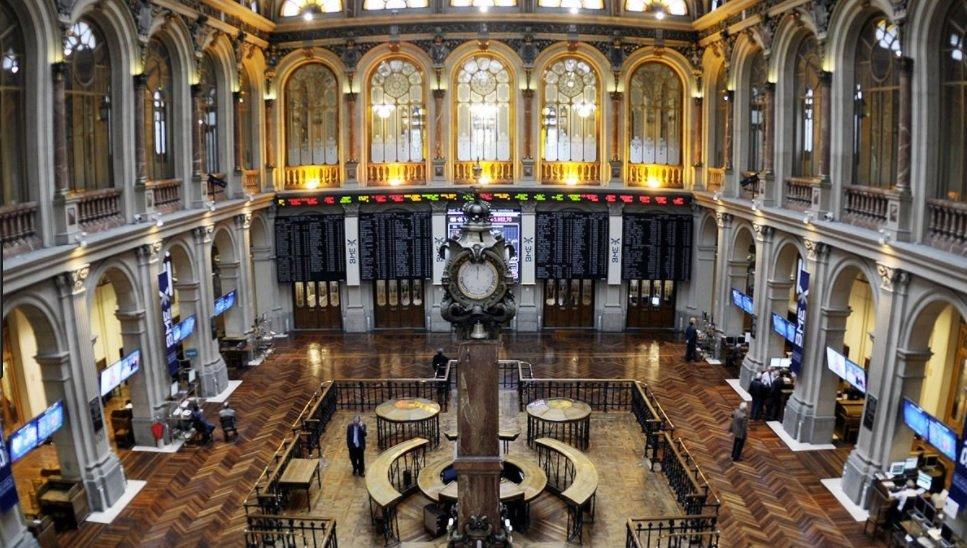

The increases are imposed on European stock markets: the IBEX 35 advances 1% and returns to 8,700

- Raquel Enríquez

This has been a day from less to more in European equities, although the end has not been been as bustling as it seemed before the lockdown. In any case, the stock markets began the day with losses of more than 1.5% and have closed in positive territory, moving at the pace set by Wall Street. The Spaniard is one of those who have behaved best from the first hour, although in the last stretch of the session she has lost her luster. The Ibex 35 rises 1% to 8,706 points, after starting this Thursday below 8,500. The EuroStoxx 50, for its part, has advanced 0.49% to 4,184.97 integers. At all times, both indices have held on to their key supports, according to Ecotrader, and have finished the day far from the intraday lows.

Joan Cabrero, technical analyst and adviser to our premium portal, assures that the key level to watch in the EuroStoxx is 4,000 integers (more than 4% below). "As long as it is above this support range, as I have been insisting, a correction context will not be activated that could be very similar to the one we are seeing on the other side of the Atlantic," Cabrero points out. In the same way, he affirms that the index must exceed 4,230 points to be able to speak of "strength".

In the case of the Ibex, the area that should not be lost sight of is 8,000, always according to this expert, so there is still a margin of eight percentage points before activating the alarms.

The national selective has been backed today by one of the sectors that have the most influence over it: the banks, spurred on by the more harsh Fed (scenario of higher interest rates). The five entities listed on the Ibex 35 have appreciated strongly, with BBVA being the least (and even so by more than 1%) and CaixaBank the most (2.72%). The latter has ended up taking the place from Banco Sabadell, which has risen 7% throughout the session after publishing its 2021 accounts (finally +2.36%).

"The results of the Catalan bank "confirm the expected evolution in net interest income from less to more in the year with low single-digit growth in line with the guidance, the greater strength of net commissions, and controlled provisions" , indicates Nuria Álvarez, an analyst at Renta 4. From Bestinver they have improved their assessment of Sabadell after knowing the annual balance.

Nevertheless, Siemens Gamesa has led purchases on the Ibex, continuing its recovery after the 'bump' last Friday. Today it registers 7.68%.

In contrast, Solaria leads sales, dropping more than two percentage points. Grifols was close, Meliá also dropped more than one point and Inditex lost 0.83%.

Until shortly before the opening of Wall Street, calm and caution prevailed in the markets of Europe (with the exception of the Ibex). What has made the tone in the markets change? The macroeconomic data that have been published.

It has highlighted the first reading of the gross domestic product (GDP) of the United States relative to the last quarter of 2021. The consensus of analysts expected an expansion of 5.5%, that is to say, a "pretty good" figure in itself, assured the Bankinter analysts. But quarterly GDP has finally been even better: 6.9%. And in the whole of 2021, growth in the US was 5.7%, the best data since 1984.

At the same time that the GDP was known, the weekly unemployment figure in the North American country was also published, as every Thursday. On this occasion, requests for unemployment benefits have remained stable.

How to crack and activate Adobe cs4 products- last days i got my 64-bit version of my cs 4 and i found my old CORE ... http://bit.ly/1Xrcep

— WareZ PluS Tue Oct 27 15:38:59 +0000 2009

In Spain, coinciding with the opening of the stock market, the unemployment rate has also been known. "Employment data have evolved favorably throughout 2021," they say from Bankinter.

The balance sheet of the Fed and Ukraine

"The Fed's announcement has not pleased the markets at all", Link Securities analysts confirm. In fact, the Asia-Pacific stock markets have preceded those of Europe with massive sales this morning (Japanese Nikkei 225: -3.11%; Shanghai: -1.78%; South Korean Kospi: -3.13%; Asx 200 Australian: -2%). Because? For the latest news from the US central bank.

Yesterday the Federal Reserve (Fed) complied with the expected script: it kept interest rates at their current level (historical low of 0%-0.25%), although it anticipated that it would raise them "soon"< /b> (analysts take for granted that in March), and maintained its road map in the withdrawal of monetary stimuli to the economy (tapering).

However, there was a negative note in the Fed's announcement: it insisted on reducing the size of its balance sheet once it starts raising rates, which "is bad for stocks", they say from Bankinter's Analysis Department.

However, the Fed gave no information on when it will begin to reduce the balance sheet (a process known in financial jargon as Quantitative Tightening) or at what rate. "We will have to wait for future meetings to have more details about it," they lament from Renta 4.

Thus, the disappointment about the Fed adds to other factors of uncertainty that the markets were already facing since the beginning of the week, highlighting the growing tension on the Ukrainian border. "The geostrategic front is on hold. That's not bad, but now the market needs to become good to decide to rebound", Bankinter experts explain.

The latest developments in this conflict have occurred in the United States: Washington has rejected Russia's demands to prevent Eastern European countries from joining the Atlantic Alliance (NATO).

And the bonuses?

Regarding the sovereign debt market, the behavior is uneven on each side of the Atlantic. In Europe, bond sales are imposed. Consequently, interest rates rise, albeit in a contained manner.

The ten-year German paper (bund), taken as a reference by investors, raises its interest rate to -0.06%. In other words: it is just six hundredths away from having a positive return, something that happened last week for the first time since 2019. In Spain, the decade-long bond is around 0.67%.

Meanwhile, in the US the interest rate on the ten-year bond (T-Note) is around 1.8%, although this has encouraged investor purchases. Last week it stayed close to 1.9%, the highest since 2019.

And regarding raw materials, oil, which began the day with falls, remains flat at the close of the Old Continent stock markets. Brent, a benchmark in Europe, once again easily exceeds 88 dollars a barrel (yesterday it hit 90), while that of West Texas, a benchmark in the US, is around 87 dollars .

Gold, the quintessential refuge asset, fell more than 2%, standing below $1,800 per ounce.

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...