Madrigals vs Ajrams: is it possible to live off the stock market?

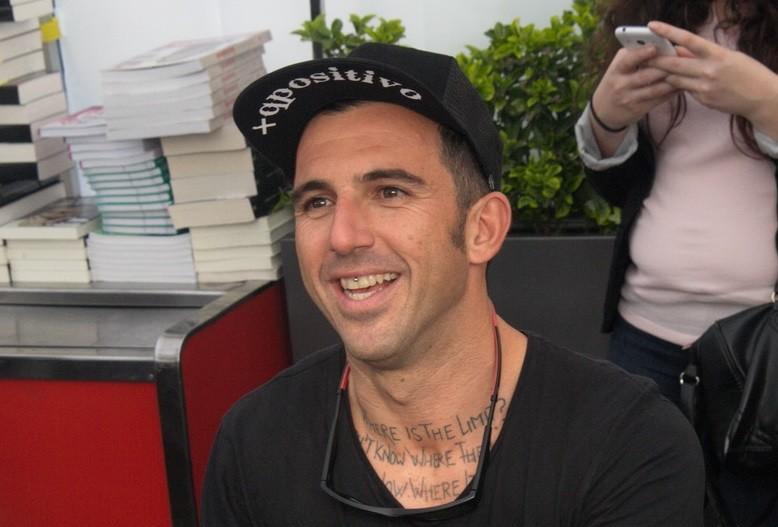

In recent years, the appearance of Josef Ajram in the media, either because of his status as an athlete or because of his status as a broker, has fueled interest in the possibility of dedicating himself to the stock market professionally among a part of the population. Especially for the opportunity to live without bosses, to reduce the working day to just a couple of hours or three a day, and for the possibilities of climbing, greater than in a conventional job.

Ajram is not the only broker who frequents the media, either general or specialized in finance, with a speech that promises the possibility of living on the stock market without the need for a huge initial capital to do so. Within the different currents that we can find in stock market investment, such as value investing or indexation, we also find technical analysis, where the aforementioned Ajram or other prominent figures are found, such as Francisca Serrano from Malaga, from Trading and Stock Exchange for clumsy, which also suggests that with proper training it is possible to live on the stock market with an initial capital that does not need to be very high.

At the other extreme, discordant voices such as that of José Antonio Madrigal, from Valencia, investor and CEO of Mercalia Global Market, who bets on totally different methods and does not miss opportunities to deny that one can live on the stock market. At least for the common mortals. "To live off the stock market you need to have a million euros, at least. And even so...", he has said at times in conferences and talks.

"The Magic of Leverage"

"I am a strong advocate of intraday trading because when I started, my capital was small. It is arithmetic: if you have 100,000 euros and you achieve a return of 10%, you will earn 10,000 euros a year. That is 833 euros to which you have to deduct taxes and commissions, you still have 650 euros... but dancing 100,000. And that was not my situation at the beginning of my life as a trader, so I had to rule out long-term investment. And 10% is already a very good cost effectiveness". It is the beginning of the story of Francisca Serrano.

Francisca has a law degree. After taking her degree, she prepared some oppositions for three years. "I dedicated eight years of my life to be entitled to a salary of 1,200 euros a month." After that, she decided she wanted something more and discovered, as she puts it, "the magic of leverage." "The upside is that if you get it right you can double, triple, quadruple, quintuple your investment. But if it goes wrong... ".

Leverage is basically borrowing to increase investment. If we have 10,000 euros and leverage another 90,000, we will have 100,000 euros to invest. If the value of the investment increases by 10%, it will become worth 110,000. We will return the 90,000 and we will have 20,000, double the amount invested. If, on the other hand, it falls by 20%, we will lose everything, since we will have to return the 90,000 by putting 10,000 out of our own pocket.

For this practice, Francisca had to discard some financial instruments and chose others such as CFDs, Forex or the futures market. The fact that she was a novice made her move away from the gold or commodity markets as well, and she ended up opting for the S & P 500 in the mini version of her. There she began not to leave open positions at night. Above all, because the required guarantees were much higher.

"Earn the most by trading the least"

"I started day trading with scalping: get in, take money, get out fast. My daily goal is 200 euros for a single contract, that's what I try to achieve every day. If I achieve it, I'm satisfied. Yes I enter another contract, I raise my stop to break-even, it's already a protected position." The same day that Francisca explains this to us, she also tells us that she has made more than nine hundred euros in profit in less than fifteen minutes. "The day trader should aim to trade as little as possible, earn as much as possible, and turn off the screen. We trade to live, to have the day to ourselves."

This last argument is one of the most seductive to those who listen to siren songs and consider a future with hyper-reduced working hours. The aforementioned Josef Ajram, who has not responded to our request for an interview, makes similar arguments. With initial investments of even 10,000 euros, he has come to talk about the possibility of living off the stock market intraday.

"I have met thousands of investors in my life, from many countries. None of them consistently win intraday," Madrigal starts. "The best investor in the world is Warren Buffet and he has an average annual return of 23%. A person with 10,000 euros cannot live on the stock market. I do not know anyone who has shown me that they win intraday. Intraday is something created by brokers so that people leave many commissions, and their teachers are the ones who play with the illusion of people".

That's how tough Madrigal is with those who proclaim the benefits of this practice. "The issue with the courses these people teach is whether their students earn money or not. In my case, it only matters if my students earn money. And that's what the audits are for. Every year you have to do the income statement, It is very easy to audit a broker to know what they win or lose. And it is not enough to take an explosive year or with luck, or those who show a couple of months. This is consistency, years doing it. "

"To live off the stock market you need a million euros"

Madrigal's method bets on investing in companies that are at historical highs, leaving the action alone and reviewing the stops every two weeks. He only advises to sell and get out of them when the trend stops being bullish. "You have to be with the winners, not with the losers", he usually says. "To live off the stock market you need a million euros. Why? Because if you spend 30,000 euros to live for a year, you have 700,000 left. Imagine if you had 100,000. You would only have 70,000 left. You would need to earn more than the remaining 30,000 , you have to pay taxes on what you earn and also raising 30,000 from 70,000 costs much more than from 100,000".

Francisco Lodeiro, investor and founder of the Investment Academy, has a similar opinion, although he bases his method on value investing, Benjamin Graham's method, and rejects the technical analysis supported by some studies that maintain that none of his patterns manages to beat the market consistently. For Lodeiro, those who offer these intraday trading strategies promise impossible returns.

According to Graham's theory, the stock market works in the short term driven by psychology, but in the long term what matters is the results. It is something that he explains with an example: "If Inditex is worth much more today than it was ten years ago, it is because it has not stopped growing. It sells more, earns more, has more stores... And if many real estate companies are worth almost nothing or directly zero, it is because their business is no longer worth anything. They're heavily indebted, they've diluted their investors, or they've gone bankrupt. Why is Apple the biggest company in the world? Because it makes a lot of profits and makes a lot of money."

Continuing with Inditex, he recalls its trajectory: before the economic crisis it was trading at ten euros per share, then it fell to less than five. Today it is around thirty. For Paco, investing in Inditex has always been a good deal, but it has been possible to find even cheaper depending on the moment. The basis of value investing.

Madrigal thinks something similar about these "impossible returns": "Let them show me that they achieve these returns. Give me audited and sustained data with them." Lodeiro considers that those who promise them do so in order to sell investment books and courses, but they never offer funds because it would be discovered that these returns are not real. Something that has not happened with Josef Ajram, who did open his own investment fund. Let's see the data that is published on his own website about his profitability so far this year:

While the IBEX has risen 6.1% so far this year, Ajram's SICAV has lost 10.99%, an amount to which commissions must be added. This is precisely what surprises Lodeiro. "They don't usually set up funds because their beach bar would be dismantled," he says, referring to himself. to low returns, especially compared to those promised. Another source tells us that he participated in one of Ajram's courses, where "three-figure" annual returns were promised. Far from what has been achieved at the moment.

Francisca Serrano, in any case, does not deny long-term investment. For her, day trading is the way to "make money in the long run." In addition, she advises against having more than 20% of our assets in the account for trading. "What we get is what we take to an investment portfolio of stocks, mutual funds, real estate, buying gold, many things for the future. I am in favor of both methods, but if you go down the street you will not find to many who can invest 100,000 euros in the stock market".

Faced with requests for audits from investors like Madrigal, Serrano says that it only makes sense to do them to all of her students, without bias, and that for this she has to wait a year for everyone to complete the courses

Regarding the aforementioned returns, the audits and the monitoring of the students, Serrano explains that his complete training consists of four courses, and that those who are now finishing have done all four, so "within a year" he will be able to answer, when the first year of students who have already completed the course. And yet, she indicates that "those who start have a hard first period, it is normal to lose the first trading account.

Francisca also points out that "it is of little use to carry out audits if you do not take all the students who have completed all the training; or ask for an audit and take only those who win, I see it more honest to take in the future all those who have finished my four courses. And when I say take all the students, it means all of the four courses; it is the intention that I have in the future. I do not believe in audits if they are used as marketing. I do believe in notaries". At the same time, she recognizes that these students will have to allow it, and that they have already been warned.

She leaves a final message: "Traders exist regardless of who weighs; not everyone is going to achieve it, because you have to want it and it requires the time it takes to train. Without training it is very difficult to be a trader".

Image | Wikipedia

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...